A financial plan for the whole you

No matter your aspirations or where you are in your planning journey, our advisors can help you build a comprehensive, customized plan to help you pursue your goals.

Build Your Plan

The reason you invest isn't just to see your wealth grow.

It may be to retire comfortably ahead of schedule, fund your child’s education, buy that house by the beach, or maybe even travel the world. What you’re saving for is just as important to us as how you get there, which is why we’ll help you build a long-term, goals-based strategy that considers your entire financial picture.

We always start with you.

Our advisors spend time with you to understand your circumstances, your family, and what your expectations are for the future. We help you quantify and prioritize your goals to lay the foundation of your financial plan.

Financial health is more than wealth.

Fiscal fitness means more than just investing. Together, we take a look at all your assets, liabilities, and accounts that contribute to your financial wellness, no matter where they’re held.

Analyze, adjust, and update.

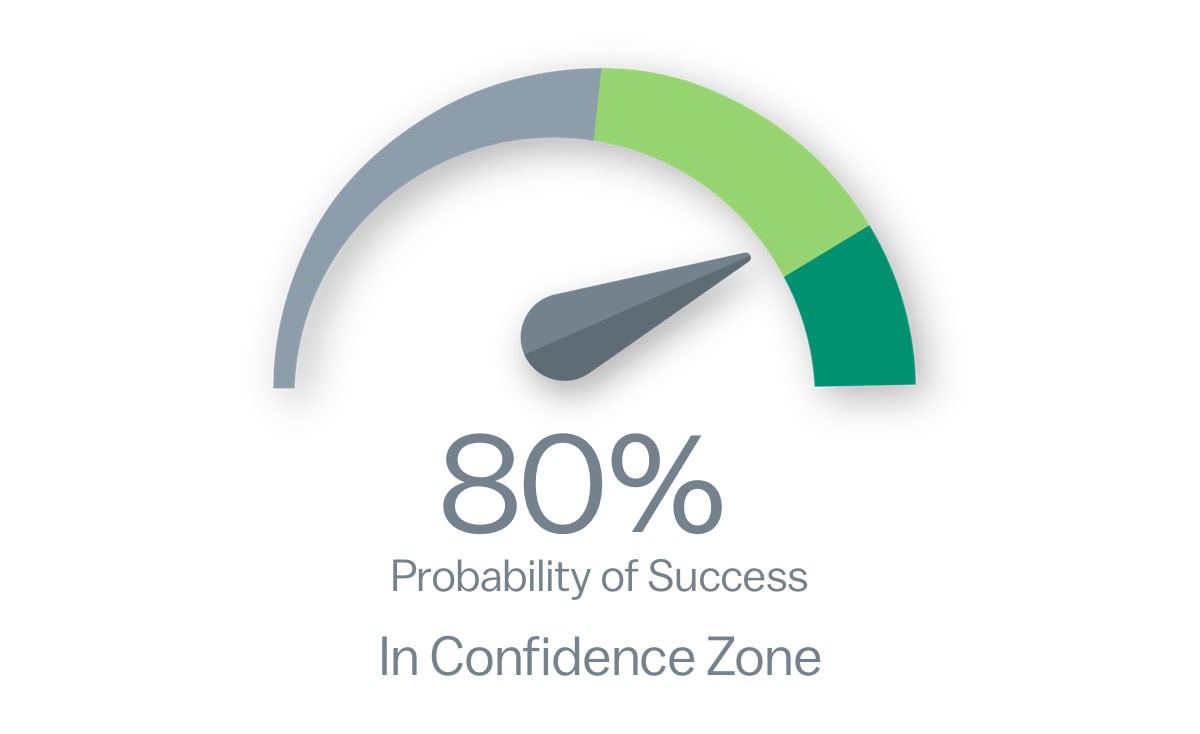

With Wealth Goals, we layer in forecasts and simulate the performance of your plan across numerous scenarios to identify strategies that can help improve the likelihood of achieving your goals.

Change of plans?

Speak with your advisor who can bring in a team of specialists to help address

your unique needs.

We can help you prepare for the unexpected.

A well-designed financial plan doesn’t end if you or a loved one passes away. It merely evolves. Our estate planning specialists can help you craft an estate plan for the unique circumstances you and your family face.

You’ve worked hard to get where you are. We’re ready to assist you with creating a long-term plan geared toward helping you retire your way.

Like any financial goal, planning in advance for the cost of higher education is key. Our advisors can help you navigate your options and find the right fit for you based on your goals.

Insurance is an important component of a healthy financial plan. When was the last time you reevaluated your existing policy? Our advisors can work with you to help mitigate your unique risks.

Get answers to frequently asked investment questions

What is a retail investor?

Retail investors are individuals who independently invest their own money in a variety of asset classes—such as stocks or bonds—through brokerage firms or their retirement accounts. Institutional investors, on the other hand, are companies or organizations managing pensions, hedge funds, endowments, and mutual funds, that are investing on behalf of a group of investors.

What is a fixed income investment?

A fixed income investment is the purchase of a bond or certificate of deposit (CD) that has a predetermined, set interest rate. Investors are paid interest annually until the bond or CD matures, at which point they recoup their initial investment. Fixed income investing can be a lower-risk strategy compared to investing in stocks. The objective is to preserve capital and income.

Governments and corporations often fund operations and projects by selling debt securities. For example, a company may issue a $5,000, 10-year bond with a 3% interest rate. If you purchased that bond and held it to maturity you’d be paid $150 annually for 10 years (3% of your investment amount). At maturity, you would also recoup your $5,000 investment.

Certain fixed income investments provide a guaranteed return—U.S. Treasuries, for example, are backed by the full faith and credit of the Constitution—and many are generally safer than stocks, although no investment is risk-free. There are a number of risks to be considered with fixed income investing, such as the potential that an entity might go bankrupt and not be able to pay back bondholders. Credit ratings can provide an indication as to an entity’s creditworthiness. The higher the credit rating of a company or government, the more likely it will be able to pay back its bondholders. An additional risk is inflation; if inflation rates outpace a bond or CD interest rate, bondholders will have lost purchasing power on the money they invested.

CDs are FDIC insured to specific limits and offer a fixed rate of return if held to maturity, whereas investing in securities is subject to market risk including loss of principal.

What is value investing?

Value investing involves attempting to identify and then buy a stock whose price you believe to be undervalued. When you’re right, you’ve in effect bought that stock at a discount.

This long-term investment strategy is based on deep analysis of a company’s characteristics and potential. Value investors might study metrics including price-to-earnings ratio, cash flow, competitive advantage, target market, and business model.

Value investors look for opportunities born out of investor overreactions. They believe that investors are prone to making emotional decisions based on good or bad news and attempt to take advantage of a dip in stock price.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

What is yield to maturity?

Yield to maturity (YTM) is the annual rate of return on a bond if you did not sell it before it matured. It is expressed as a percentage. YTM includes all the interest the bond would pay annually, known as coupons, plus recoupment of your original investment after the bond matured. It is a useful tool for fixed income investors to compare bonds with different coupons and maturity dates.

YTM is a complex calculation and meant only as a projection. It assumes all interest or coupon payments are reinvested at the bond’s current yield, which may not always be possible or even likely. The formula factors in the bond’s current market price, the coupon payments, the recoupment amount, and the term to maturity. Because a bond’s coupon interest rate fluctuates, YTM on any given bond will fluctuate. YTM does not take into account taxes paid by the investor or investment costs related to the purchase.

Check our background.

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck.

Insurance products are offered through LPL or its licensed affiliates. Wilmington Advisors @ M&T is a brand name used by LPL representatives to offer securities, advisory, and insurance services and is not a separate legal entity. Registered representatives of LPL using the Wilmington Advisors @ M&T name are employees of M&T Bank. LPL and its affiliates are entities separate from, and not affiliates of, M&T Bank. Securities and insurance offered through LPL or its affiliates are:

Not Insured by FDIC or Any Other Government Agency | Not Bank Guaranteed | Not Bank Deposits or Obligations | Subject to Investment Risks, Including Possible Loss of Principal Amount Invested

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

To read LPL Financial disclosures and agreements, please visit their site. To read the M&T Bank Cash Account Disclosure Booklet, please click here.

The content of this page is for informational purposes only. It is not designed or intended to provide financial, tax, legal, investment, accounting, or other professional advice since such advice always requires consideration of individual circumstances. Please consult with the professionals of your choice to discuss your situation.

The recommendation by M&T Bank of LPL is made pursuant to an agreement that allows LPL to pay M&T Bank for these referrals. This creates an incentive for M&T Bank to make these referrals, resulting in a conflict of interest. M&T Bank is not an investment advisory client of LPL. Please visit www.mtb.com/wilmington-advisors/disclosure for more detailed information.

Investing involves risks, and you may incur a profit or a loss. There is no assurance that any investment strategy will be successful.

©2023 M&T Bank and its affiliates and subsidiaries. All rights reserved.

M&T Digital Privacy Notice | Terms of Use Equal Housing Lender. © 2023 M&T Bank. Member FDIC. All rights reserved.