Bank to Bank Transfers

Easily move your money between financial institutions.

Transfer money between your personal M&T and verified non-M&T accounts.

Bank to Bank Transfers, available through Online Banking, provides the convenience to schedule money transfers between your M&T personal deposit account (checking, savings or money market) and a personal deposit account you have at another financial institution in the United States.

The combined limit for inbound and outbound transfers is $2,000 per day and $5,000 within any 30 day period.

To begin, simply log in to M&T Online Banking and, under the Payments and Transfers menu, navigate to Bank to Bank Transfers.

Manage your non-M&T account(s)

You can link verified accounts to transfer money.

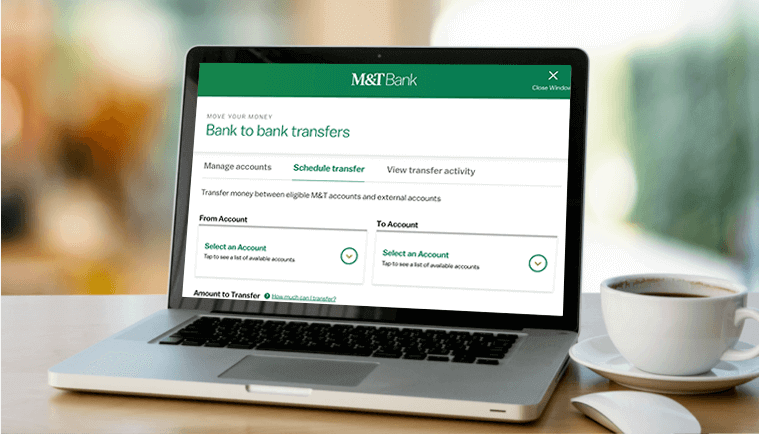

Schedule your bank to bank transfer

You can select the accounts, the transfer amount and the transfer date.

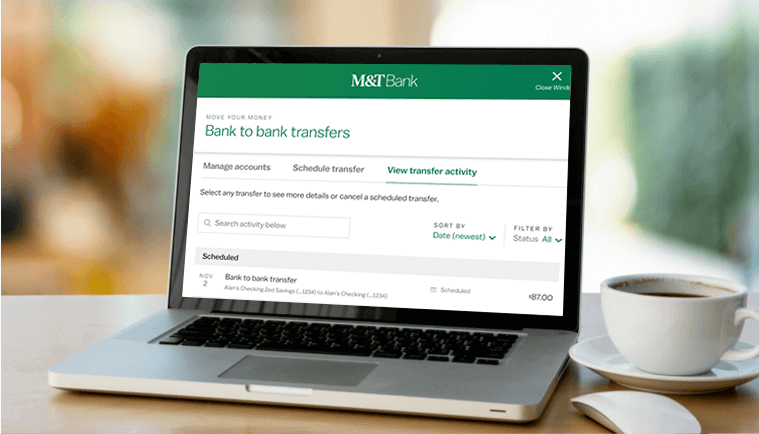

View transfer activity

You can view the status of previous and scheduled bank to bank transfers.

Bank to Bank Transfers FAQs

A bank to bank transfer is an electronic transfer of money between your M&T personal deposit account (checking, savings or money market) and a verified non-M&T personal deposit account you have at another financial institution.

Your non-M&T deposit account used must be in the United States of America and be held solely for personal, family or household purposes. Business accounts are not eligible. Transfers with external accounts held solely by third parties are not eligible and some personal accounts may not be eligible (examples: trust account, individual retirement account or accounts that limit electronic fund transfers).

Bank to bank transfers can be made between your M&T personal deposit account(s) including, M&T Checking, Savings or Money Market and your verified non-M&T personal deposit account(s).

Note: The Bank to Bank Transfers service is only available through Online Banking.

The combined limit for inbound and outbound transfers is $2,000 per day and $5,000 within any 30 day period.

No. Recurring transfers will need to be scheduled individually. This feature will become available at a later date.

Bank to bank transfers will generally process within 3 Business Days after the Business Day that we receive the Transfer Instruction, if received prior to 8:40pm EST. Outbound transactions will be debited immediately and external accounts will generally be credited within the next business day. Inbound transfers will generally be debited either same day or the next business day and credited to your M&T account within 3 business days.